-

PETRONAS

PETCO Trading (UK) Limited

- UK Tax Strategy

- Statement under the Modern Slavery Act

- Publications

- Contact Us

Business Strategy, Corporate Social

Responsibility and Tax ObjectivesPETRONAS Group is committed to complying with all applicable tax laws in the UK and all the countries in which it operates. The key objective of our strategy is to ensure that tax affairs of the Group are in good order and uncertainties are minimised. We recognise our social responsibility towards all our stakeholders and believe tax has a role which we are part of and the taxes we collect on behalf of tax authority, and pay are one of the ways in which we can meet this responsibility.

Approach to Risk Management and Governance

arrangements in relation to UK taxationLow Risk Tolerance

PETRONAS with its presence throughout the world places utmost emphasis on control and governance on its financial risks which are implemented, maintained, and monitored through the adaption of tax and governing policies. We continue to have a low tolerance to tax risk by undertaking commercial activities with consideration on overall tax consequences and supported by underlying relevant policies and guidelines

Good Faith

PETRONAS Tax Policy prescribes our commitment to being a responsible taxpayer by complying in good faith with all applicable tax laws, regulations, guidelines, and international tax treaties, and setting tax obligations when legally due, as a company and employer

Governing Policies

PETRONAS Group’s governing policies affect the consistent practice of prudent tax management and tax optimization for the PETRONAS Group of companies. The Group Tax oversees and monitors the implementation of overall tax policies and guidelines, as well as forming the foundation upon which taxes are identified and strategies to manage such risks are developed

Expert Advisors

Compliance is the responsibility of the company but where appropriate, reference is placed on PETRONAS Group Tax and/or external advisors for their advice relating to tax in the context of commercial transactions, updates, and interpretation of tax legislation

Approach on Tax Optimisation so far as affecting UK taxation

Balance Tax Optimisation

PETRONAS Group balances tax optimisation with appropriate tax risk management by adopting valid and supportable positions and maintaining awareness of other prevailing views and risks. When entering commercial transactions, PETRONAS seeks to utilize available tax incentives, reliefs, and exemptions in line with, and in the spirit of, tax legislation and ensure involvement only in genuine arrangements.

PETRONAS seeks to fully comply with relevant tax law and adheres to relevant guidance issued by the Organisation for Economic Co-operation and Development (OECD) (or its equivalent where relevant) for international tax matters. In accordance with OECD Transfer Pricing guidelines, all our transactions are carried out based on the “arm’s length principle”, which is the international consensus on the valuation of cross-broader transactions between associated enterprises

Level of Risk in relation to UK taxation acceptable to the Group

Comply with regulations and obligations

PETRONAS Group is committed to complying with all applicable tax laws in the UK and all the countries in which it operates. The key objective of our strategy is to ensure that tax affairs of the Group are in good order and uncertainties are minimised. We recognise our social responsibility towards all our stakeholders and believe tax has a role which we are part of and the taxes we collect on behalf of tax authority, and pay are one of the ways in which we can meet this responsibility.

Approach to dealing with HM Revenue & Customs (HMRC)

Working Relationship

Transparent

List of entities covered by this tax strategy

- PETCO Trading (UK) Limited

- LNG Investments Europe Limited

- PETRONAS Lubricants Great Britain Limited

- PETRONAS Energy Trading Limited

- FL Nominees Limited

- MISC Berhad (UK) Limited

- AET UK Limited

List of entities covered by this tax strategy

- PETCO Trading (UK) Limited

- LNG Investments Europe Limited

- PETRONAS Lubricants Great Britain Limited

- PETRONAS Energy Trading Limited

- FL Nominees Limited

- MISC Berhad (UK) Limited

- AET UK Limited

PETRONAS is committed to maintaining good cooperative working relationships with tax authorities on all tax matters in a timely manner. PETRONAS has been transparent in providing information and has always worked closely with HMRC Customer Compliance Manager, which includes specific discussions and obtaining confirmation on matters pertaining to its tax affairs.

Introduction

This is a statement of PETCO Trading (UK) Limited (“PTUK” or “Company”) in respect of the Modern Slavery Act 2015 compliance.

PTUK is committed to assessing the risk of modern slavery and human trafficking in our business and supply chain and we are working on developing new practices which aim to identify and mitigate such risks.

About PTUK

PTUK is a UK based wholly-owned subsidiary of PETRONAS Trading Corporation Sdn Bhd, which is a wholly-owned subsidiary of Petroliam Nasional Berhad (“PETRONAS”) the Malaysian state-owned national energy company.

The Company’s business is to market, source and trade crude oil, petroleum products, gas and LNG internationally, with particular focus in the West of Suez markets (UK, Europe, Mediterranean, Caspian, West Africa and the Americas) for the PETRONAS Group.

Business and Supply Chain

Our employees have a hybrid working arrangement between the office and home. Accordingly, the key modern slavery risk areas are in our supply chain. Outside the primary business outlined above, the main categories of supply chain contracts of PTUK are in respect of office services, IT, professional services and business travel.

Policies and Risk Mitigation

PTUK is committed to ensuring there is no modern slavery or human trafficking in our business and supply chain and is committed to ensuring that it conducts its business in a manner that respects fundamental human rights and the dignity of all people. We are guided by the Universal Declaration of Human Rights, the United Nations Guiding Principles on Business and Human Rights and the 1998 Declaration on the Fundamental Principles of Rights at Work of the International Labour Organisation (“ILO”).

We strive to ensure that we work and maintain relationships with suppliers and customers who are recognised as being economically, environmentally and socially responsible. PTUK expects its partners to obey national and international standards that require the fair and ethical treatment of workers and employees and the provision of a safe working environment.

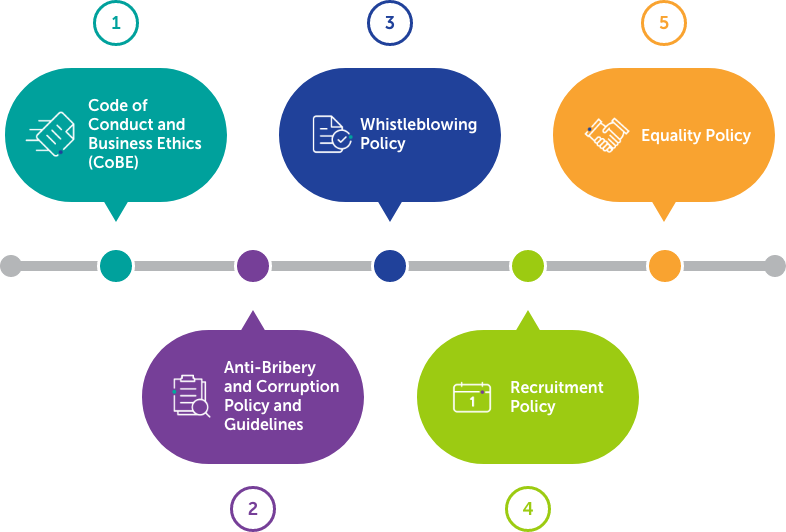

PTUK has an Anti-Modern Slavery and Human Trafficking Policy to guide the Company and its staff in tackling any prospect of slavery or human trafficking in the Company’s business and supply chain, and has also adopted PETRONAS’ Human Rights Policy in 2024. PTUK also applies the following policies in its business under the PETRONAS Group:

The Company will continuously consider the above policies to determine whether any improvements can be made to assist with the detection and prevention of modern slavery and human trafficking in its business and supply chain.

The CoBE applies to every individual working for or on behalf of the entire PETRONAS Group. It underpins the mission, vision and values of PTUK and requires all employees to commit to the highest standards of integrity and professionalism, mandating that business affairs are undertaken in an ethical, non-discriminatory and transparent manner.

Know-your-customer (“KYC”)

The Company has a thorough vetting process of counterparties which includes crew metrics for vessels. Our standard Group KYC questionnaire includes human rights questions where vendors and counterparties are queried on their human rights commitments, training to employees, grievance mechanisms for employees and compliance with laws and principles for the protection of human rights and prevention of modern slavery and human trafficking.

The PETRONAS Human Rights Commitment can be viewed at:

https://www.petronas.com/sustainability/governance-and-ethicsContracts

We include in our contracts an anti-slavery clause mandating compliance with the Modern Slavery Act 2015 even if the contract is performed outside the UK.

Training

PTUK provides mandatory training on anti-slavery and human trafficking to its management and employees.

Key Performance Indicators

PTUK aims to have 100% of staff trained on anti-modern slavery and human trafficking by the end of each year, therefore new recruits are trained to maintain that 100% level, and periodical training will be given to all staff as a refresher.

Declaration

This statement is made pursuant to Section 54 of the Modern Slavery Act 2015 and constitutes PTUK’s modern slavery and human trafficking statement for the financial year ending 31 December 2024.

Jazlinawati Osman

CEO, PETCO Trading (UK) Limited

17 April 2025Date Title File 24/06/2024

PETCO Trading (UK) Limited - Section 172 Statement for FY2024

24/06/2024

LNG Investments Europe Limited - Section 172 Statement for FY2024

- Terms of Use

- Privacy Statement

- Cookies Settings